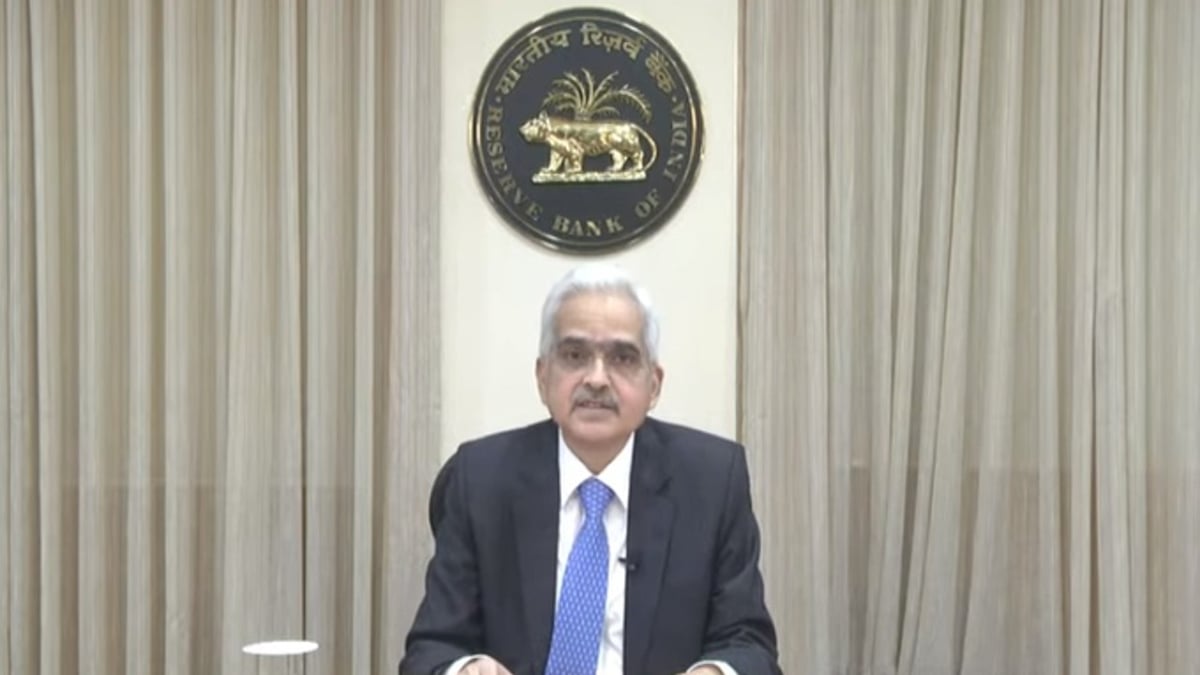

RBI MPC: Will you get the gift of cheap interest today or will you have to wait?

RBI MPC: Today is the last day of the two-monthly meeting of the Monetary Policy Committee (MPC) of the Reserve Bank of India for the new financial year (2024-25). It is being told that at 10 am in the morning, the Governor of the Reserve Bank will hold a press conference and give information about … Read more