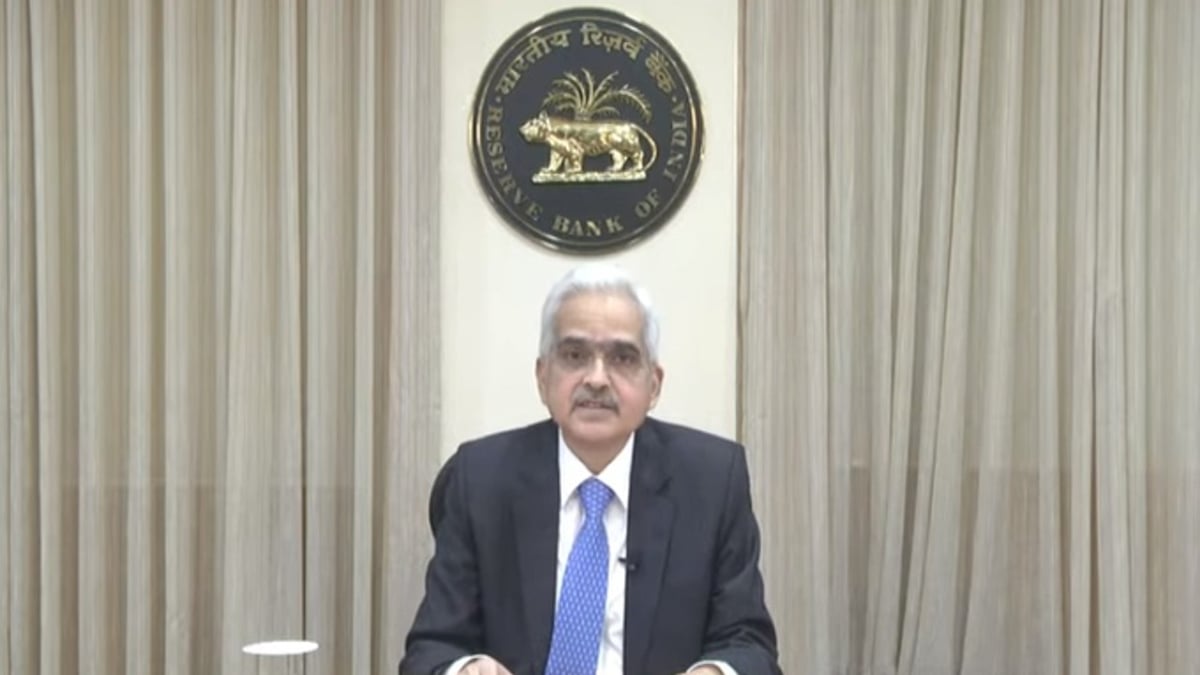

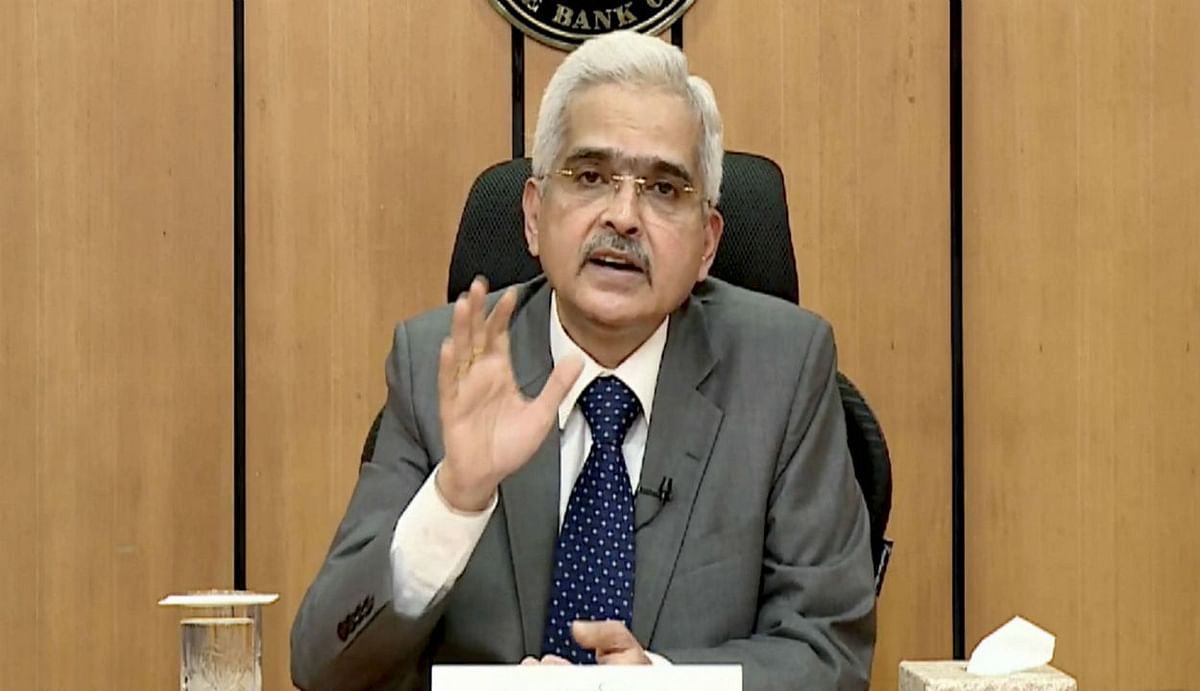

RBI Repo Rate: Reserve Bank kept the repo rate at 6.5%

RBI Repo Rate: An important announcement regarding the repo rate has been made by the Reserve Bank of India on the last day of the Monetary Policy Committee (MPC) meeting under the bi-monthly review. Bank Governor Shaktikanta Das said that the apex bank has again kept the repo rate intact. This is the sixth time … Read more