RBI Monetary Policy: Will loans become costlier in February? RBI will take decision regarding interest rates, know expert’s opinion

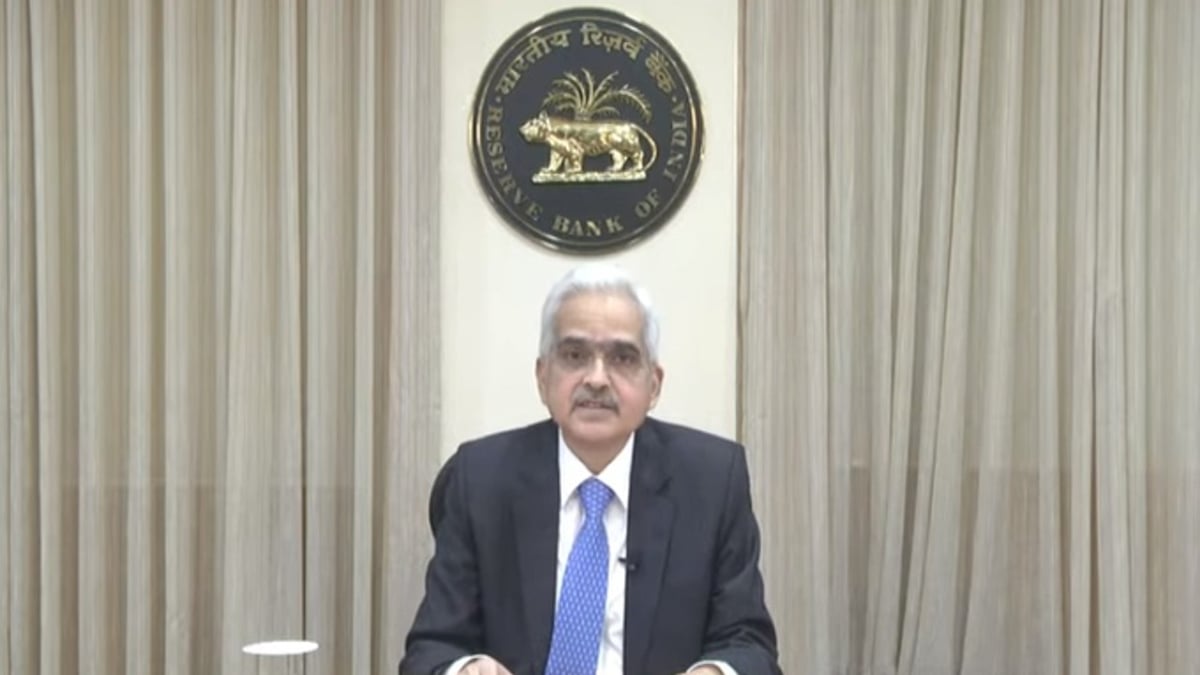

RBI Monetary Policy: Interim Budget (Interim Budget 2024) after the Reserve Bank of India (Reserve Bank of India) is going to hold bi-monthly monetary policy meeting. The meeting is going to be held on February 6. It will be organized for three days. On February 8, Reserve Bank Governor Shaktikanta Das (Shaktikanta Das) will announce … Read more