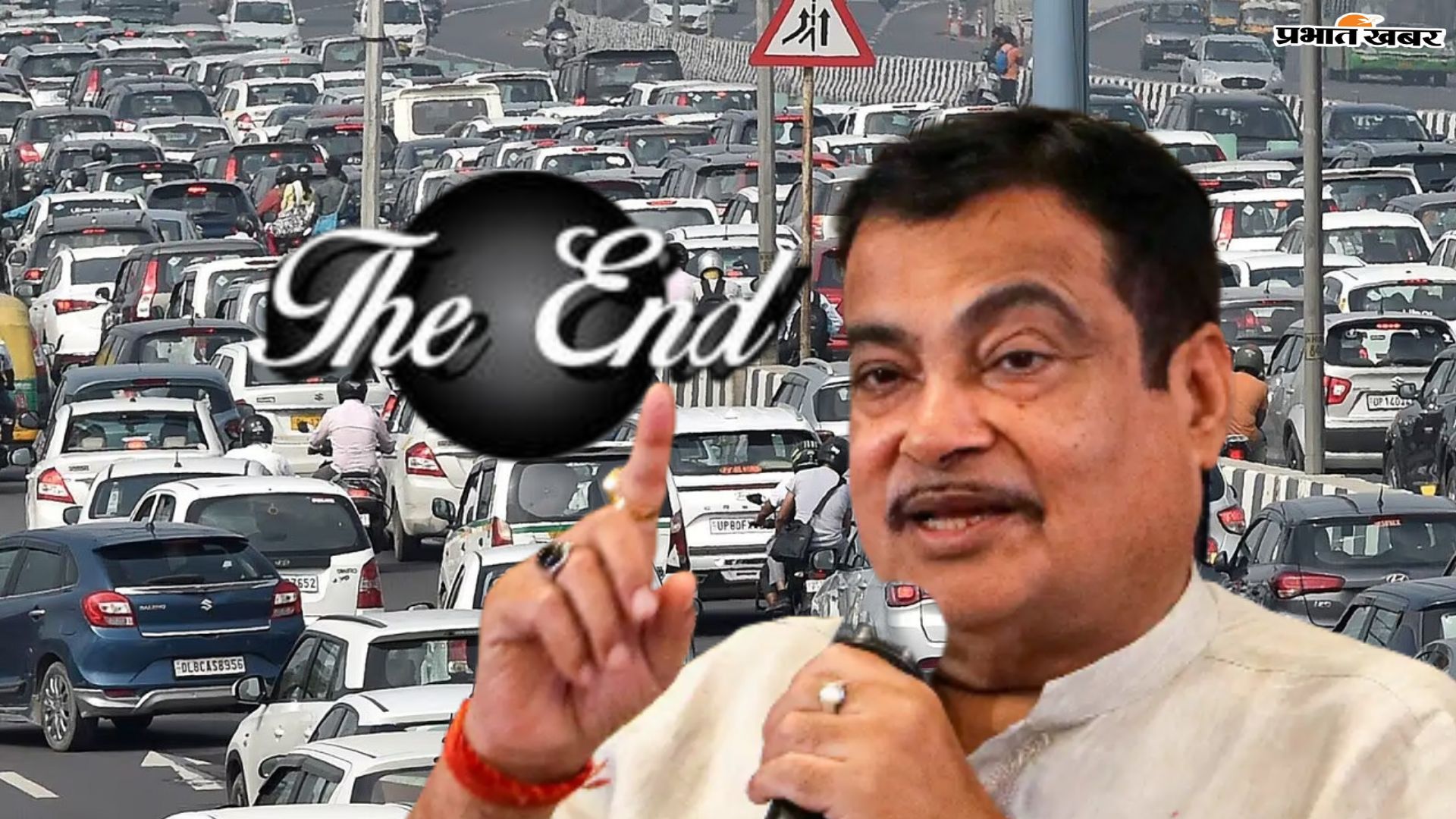

36 crore petrol-diesel vehicles closed, hybrid started…

Petrol-Diesel Vehicles: Union Road Transport and Highways Minister Nitin Gadkari has pledged that he will stop only after shutting down more than 36 crore petrol-diesel vehicles running in India. In return, hybrid vehicles will be promoted. That is why he has also advocated reducing the Goods and Services Tax (GST) on hybrid vehicles to make … Read more