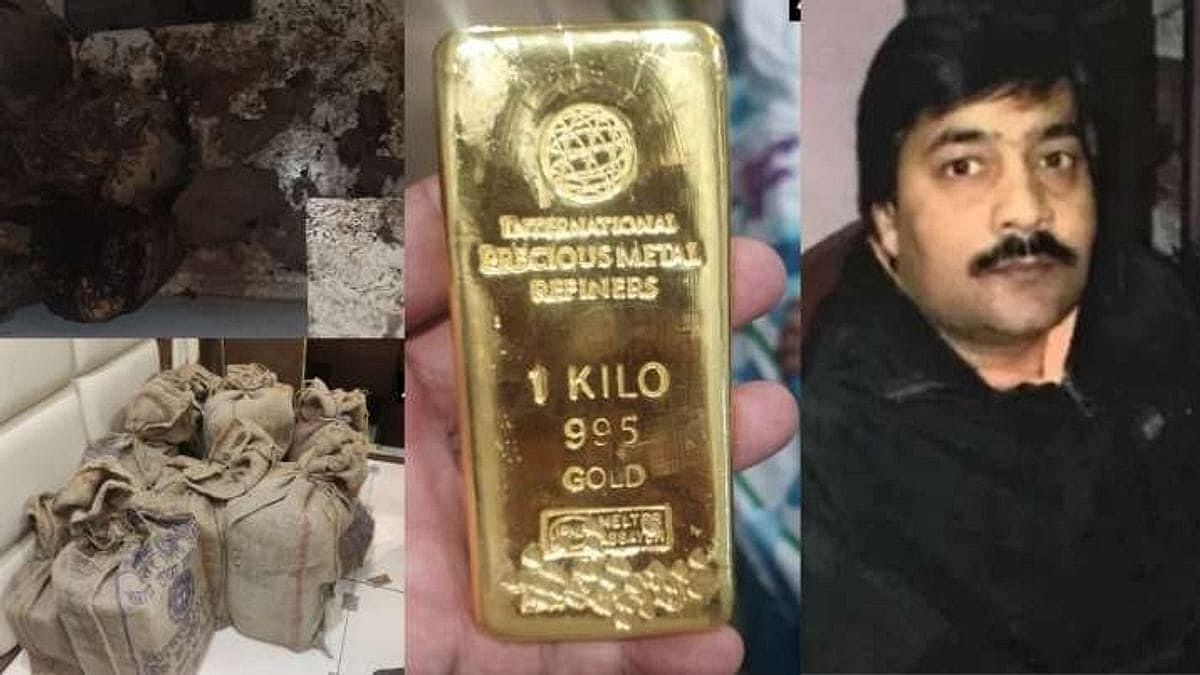

Gold-Silver Import: People bought gold with bags full, import increased by 26.7 percent to 35.95 billion dollars in nine months

Gold-Silver Import: The love of the people of India for gold is the highest in the whole world. Due to this, a new record of gold purchase is being created every year. It is now being told that gold import in India has increased by 26.7 percent to $35.95 billion in the first nine months … Read more