Market Cap: The market capitalization (market cap) of seven of the top 10 Sensex companies declined collectively by Rs 62,279.74 crore last week. Reliance Industries suffered the most. Apart from Reliance Industries, Tata Consultancy Services (TCS), ICICI Bank, Hindustan Unilever, ITC, State Bank of India (SBI) and Bharti Airtel declined in market valuation during the week under review. On the other hand, the market position of HDFC Bank, Infosys and Bajaj Finance increased. The market capitalization of Reliance Industries declined by Rs 38,495.79 crore to Rs 16,32,577.99 crore during the week. The market valuation of Hindustan Unilever declined by Rs 14,649.7 crore to Rs 5,88,572.61 crore and that of Bharti Airtel declined by Rs 4,194.49 crore to Rs 4,84,267.42 crore. ITC’s market cap declined by Rs 3,037.83 crore to Rs 5,50,214.07 crore and ICICI Bank declined by Rs 898.8 crore to Rs 6,78,368.37 crore.

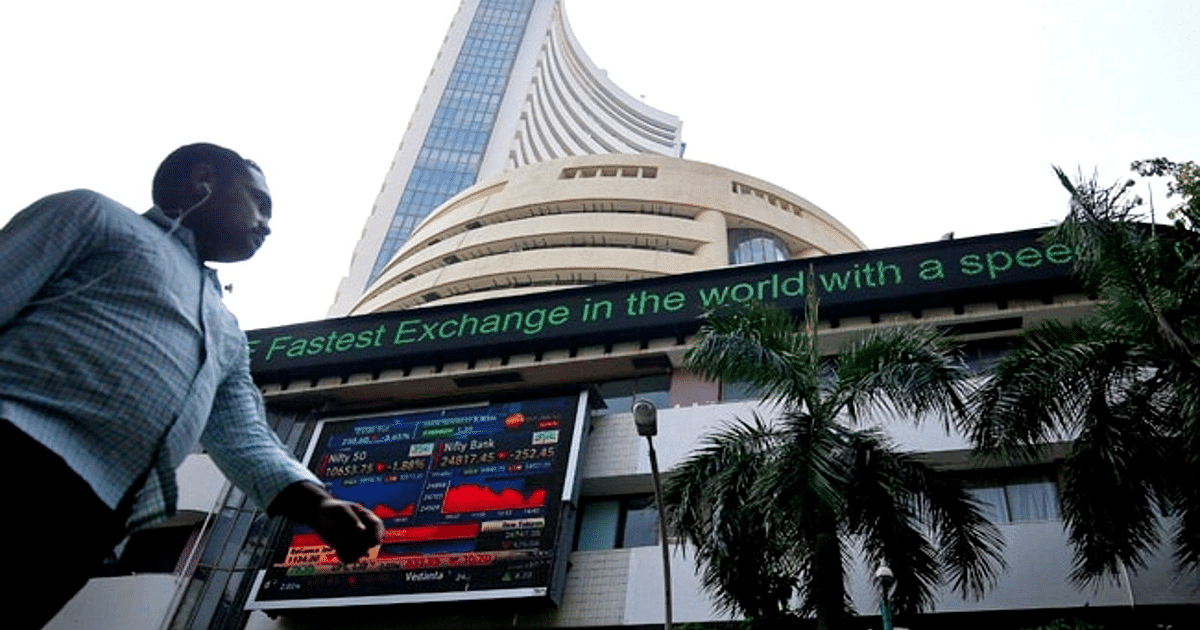

BSE Sensex gained 500.65 points

The market valuation of TCS declined by Rs 512.27 crore to Rs 12,36,466.64 crore. SBI’s market cap declined by Rs 490.86 crore and stood at Rs 5,08,435.14 crore. Contrary to this trend, the market capitalization of HDFC Bank increased by Rs 10,917.11 crore to reach Rs 11,92,752.19 crore. Infosys’ valuation jumped by Rs 9,338.31 crore to Rs 5,98,917.39 crore. The market capitalization of Bajaj Finance stood at Rs 4,43,350.96 crore with an increase of Rs 6,562.1 crore. Last week, the 30-share BSE Sensex gained 500.65 points or 0.77 percent. Reliance Industries remained at first position in the list of top 10 companies. After that, TCS, HDFC Bank, ICICI Bank, Infosys, Hindustan Unilever, ITC, SBI, Bharti Airtel and Bajaj Finance were ranked respectively.

FPI investment in Indian stocks slowed down

After investing heavily in the Indian stock markets in the last three months, the inflow of foreign portfolio investors (FPIs) has slowed down. In August, amidst the rise in crude oil prices and the risk of inflation re-emerging, FPIs invested 12,262 crores in the Indian stock markets. Crore rupees have been deposited. Himanshu Srivastava, associate director-manager research, Morningstore India, said that FPIs are adopting a ‘watch and wait’ policy rather than taking a complete ‘U-turn’. There remains uncertainty in the global economy and the underlying scenario is changing rapidly. Is. Due to this, there will be fluctuations in the flow of FPI. According to depository data, foreign portfolio investors invested a net Rs 12,262 crore in Indian shares in August. This figure includes investments made through primary market and wholesale deals.

FPI at four month low

FPI investment in Indian shares is the lowest in the last four months. In the last three months, FPIs had continuously invested more than Rs 40,000 crore in shares. FPI investment was Rs 46,618 crore in July, Rs 47,148 crore in June and Rs 43,838 crore in May. Earlier their investment was Rs 11,631 crore in April and Rs 7,935 crore in March. Himanshu Srivastava attributed the decline in FPI investment in August to high crude oil prices and re-emergence of inflation risks as the main factors. He said that apart from this, due to increase in bond yields in America, FPIs are withdrawing their investments from risky markets. He said that due to the continuous rise in the Indian stock markets, the valuation of shares has gone above the satisfactory level of some investors.

The market was affected by the strengthening of the dollar

VK Vijayakumar, Chief Investment Strategist, Jio Financial Services, said that due to the strengthening dollar and rising bond yields, FPIs have been selling in most of the emerging markets in August. Apart from shares, FPI has also invested Rs 7,732 crore in the debt or bond market last month. With this, the total investment of FPI in shares so far this year has reached Rs 1.35 lakh crore and in the bond market has reached Rs 28,200 crore.

,with language input,